The Benefits of being a "Broke College Student"

/It is both cliché and generally accurate to assume that most college students don’t have much money lying around. This can be a serious limitation during your college years (and, with student debt, possibly a debilitating factor later), but it can also be a hidden opportunity. I imagine I’ll write a post about money management and budgeting at some later time. I actually have quite a few thoughts on the subject. But that’s not the point of what I’m writing today.

Here’s the thing: being a “broke college student” has its advantages.

If you learn to live on less for your daily expenses, then while you’re in college and for the rest of your life you’ll be able to prioritize the things that are actually important to you. There are a million ways to learn to budget, and I am no expert. But here’s something to keep in mind:

You can use your status as a broke college student as a valid excuse.

You choose your priorities.

Cost of a gorgeous hike: just the gas money and a friend with a car. (Winter 2007)

Generally speaking, as a college student I think that your goals should be education, experiences, and self-improvement. I mean these in the most positive and broad perspectives. You are investing your time and money (or someone’s money, anyway, be it parents’ or scholarships or loans) in pursuit of academic goals. That is a benefit in its own right, and should be honored as such—your biggest expenses during your college years will be the money you spend on college. Other money has to go toward the basics of living—food and housing—and the rest is more or less up to you.

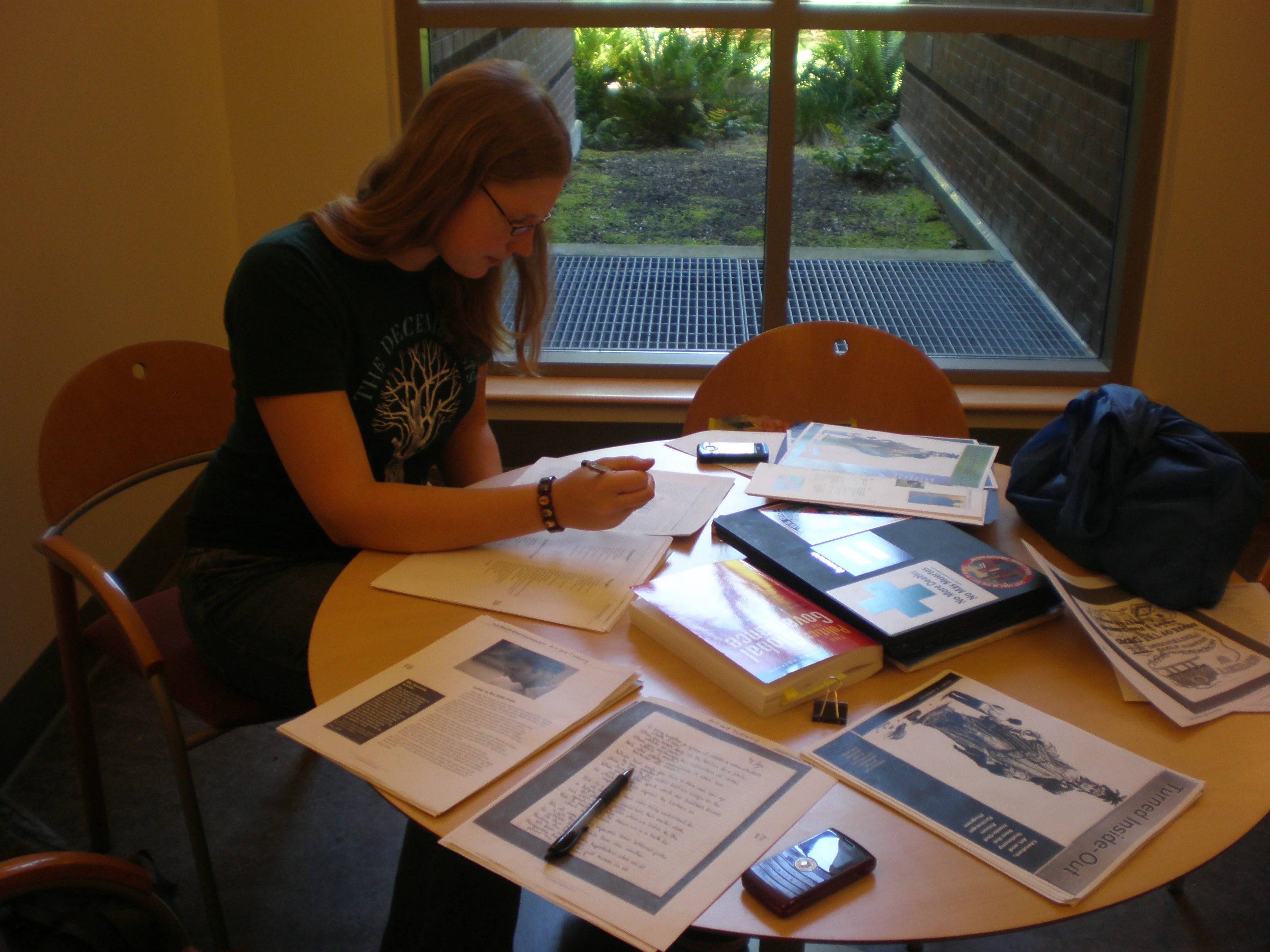

How you spend your time and money indicates what you value. Since you’ll probably be quite money-aware during your college years, take the opportunity to pay attention. If, like me, you live in the dorms your freshman year, then your housing and food costs are fixed amounts of money. So what else is important enough to spend money on?

I decided early on that it was worth spending less on day-to-day things in order to save up for big experiences. When I first planned my trip to Guatemala for the summer after my freshman year, I knew that I wanted to focus on having adventures. So during school I spent money on experiences—on trips to Oregon hot springs or to visit friends’ families. I went to campus events and bought books. I took PE classes and paid for that great stereotype of a basket weaving class.

In all other areas of my life, I adopted exceptionally frugal living. My friends and I ate in the dorms, and very infrequently spent non-meal points money on food. We watched TV in each others’ dorm rooms instead of going to the movies. We went on hikes and saw the weekly (and free) a cappela performances on campus. We had a blast doing the fun and free activities that were all around us.

The frugal lifestyle I began as a freshman carried through to the rest of my college years. I never got a car, preferring to walk to class and take public transportation further afield. I also never developed a habit of eating in restaurants or take-out, but made simple meals at home for cheap.

This kind of behavior could feel like scarcity. It could feel like you were missing out.

For me, it was ensuring my freedom.

The mindset that developed in those early college days continues now that I’m a “real grownup” with a real job. I travel all the time, but I travel on the cheap. I stay in hostels, or, even better, with friends of friends. I crash on couches, I go out for a couple of drinks instead of big drunken nights, and I keep a simple wardrobe that has everything I need. I continue to weigh expenses like restaurant meals and movies out against travel destinations, crafts classes, and the chance to work part-time and have the freedom to run the majority of my days according to my own desires. I have also had experiences and met people I never would have if I was willing to spend more money—the types of travelers who congregate in hostels are a completely different set of people. Even better, the folks who have taken me in during my wanderings (including the incredible Christine and Big John of Seattle, who have supplied me with several Sunday comfort food recipes) have become part of my broader community of people who have been such a loving part of my life.

One of the most frustrating things about living in Ireland has been that a great deal of socializing happens in public places, mostly in pubs. So instead of going to someone’s house for drinks and a movie or just hanging out, it’s much more social acceptable to go out and spend money on really expensive drinks. It’s really driven home how much I enjoyed the laid-back atmosphere in Eugene, where most socializing was done in houses (at least in my experience) and going out for live music or drinks was a special occasion. It feels homey and nice. I miss that.

As much as possible, I recommend cultivating an attitude that you can only afford the things that are really important to you. Then, when other opportunities to spend money come along, you give a rueful smile and say “sorry, I’m a broke college student.”

As a final anecdote, I’ll share a story of reverse culture shock:

The first time I stayed in a hostel was in Guatemala. It had hammocks in a porch and a beautiful, brightly-painted shared kitchen with long tables. The beds were creaky but clean. The other travelers I met there were adventurous and outgoing, and we played cards for hours and chatted about all the places we’d like to go and the adventures we’d had.

That hostel cost $3.16 per night. I’ve never looked at a fast food meal the same way since.

You might be interested in these related posts: "Textbooks: When to Buy" and "Attending Campus Events."

What are the experiences you most enjoy spending money on? What can you sacrifice to make more opportunities to follow your passions? Do you use the “broke college student” excuse? Please share your thoughts and stories here.